ACLU supports stopping bill that could revoke tax exemptions for nonprofits accused of funding terrorists.

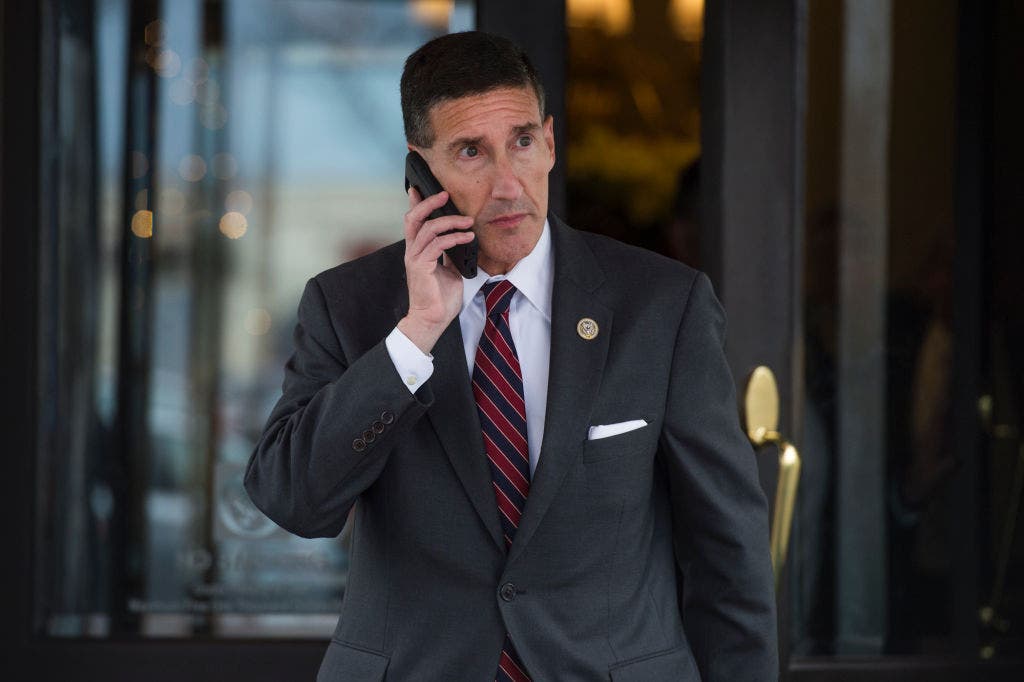

In a groundbreaking move, a new bill that aims to revoke the tax-exempt status of nonprofits found to be supporting terrorists has garnered significant bipartisan support and is making waves in Congress. Introduced by Reps. David Kustoff, R-Tenn., and Brad Schneider, D-Ill., the bill passed the House of Representatives with an overwhelming vote of 382-11 in April. Senators John Cornyn, R-Texas, and Angus King, I-Maine, have also championed a companion version of the bill, emphasizing the critical need to curb financial aid to those backing terrorist activities.

Despite the widespread backing for the bill, several organizations, including the American Civil Liberties Union (ACLU), have mounted lobbying efforts to derail its progress. The ACLU, along with groups like the Council on American-Islamic Relations and American Muslims for Palestine (AMP), have raised concerns about the constitutional implications of the bill and its potential to be exploited for politically motivated agendas.

However, proponents of the bill, like Rep. David Kustoff, are resolute in their belief in the necessity of such legislation. As one of only two Jewish Republicans in Congress, Kustoff stresses the urgent need to hold accountable those who provide support to terrorist organizations and ensure that tax-exempt status is not misused for illicit activities.

While the ACLU argues that the bill poses significant due process concerns and risks discriminatory enforcement, Rabbi Yaakov Menken of the Coalition for Jewish Values contends that organizations must prove their compliance with tax-exempt regulations to maintain their privileged status. Under the current U.S. tax code, entities lose their tax-exempt standing if designated by the Department of State as a terrorist organization, including groups like Hamas and Hezbollah.

Senator John Cornyn underscores the bill’s extension to cover organizations providing material support to terrorist groups within the preceding three years, emphasizing the need to tighten regulations and prevent the flow of resources to illicit actors. However, Kia Hamadanchy of the ACLU warns of potential misuse of power by granting extensive authority to the Secretary of the Treasury, raising concerns about the bill’s impact on free speech and political targeting.

Despite resistance from detractors, the bill’s supporters cite the alarming activities of groups like American Muslims for Palestine, who have been accused of aiding terrorist organizations like Hamas through propaganda and financial means. Recent legal action against AMP and its connections to Hamas underscore the gravity of the issue and the urgent need for legislative measures to combat such illicit behavior.

As the debate over the bill rages on, the critical need to address the misuse of tax-exempt status for nefarious activities remains a pressing concern for lawmakers and advocates alike. The balance between regulatory oversight and due process protections will continue to shape the discourse surrounding this vital piece of legislation that seeks to safeguard national security interests and uphold the integrity of nonprofit organizations.