GOP bill aims to lower tuition costs by taking money from college endowments, Harris promotes loan forgiveness.

As the new school year approaches, the issue of education costs is looming large, and it is anticipated to be a significant topic in the upcoming presidential election. At the forefront of this conversation is Rep. David Joyce, R-Ohio, who is introducing a bill with a unique approach to tackling rising education expenses – targeting bloated university endowments.

Rep. Joyce’s proposed bill, which he is co-sponsoring with Rep. Nicole Malliotakis, R-N.Y., seeks to increase the tax on private universities’ endowment profits substantially, from 1.4% to 10%. Additionally, the bill aims to lower the threshold for the tax from endowments with $500,000 per student to $250,000 per student. The rationale behind this move is to address the issue of schools taking advantage of federal loan guarantees while continuing to escalate the cost of education.

Under the provisions of the bill, universities that raise tuition rates above the inflation rate would face even greater consequences. In cases where a private university raises net tuition more rapidly than the inflation rate over a three-year period, the following year would subject them to a tax of 20% on their endowment profits.

“Our legislation will finally hold universities accountable for their role in fueling the student debt crisis and push them to limit exorbitant tuition hikes,” stated Rep. Malliotakis.

Statistics from the Department of Education reveal that the average expense for tuition, fees, room, and board for the academic year 2022-23 hit $30,884, a sharp contrast to the $12,992 cost in 2000-01.

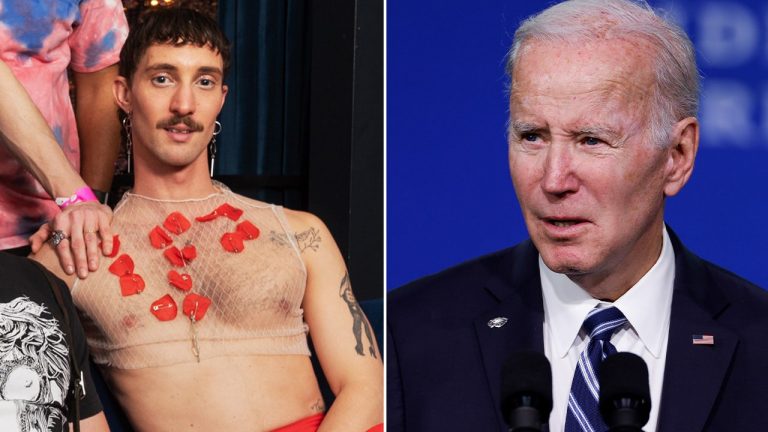

These developments are unfolding against a backdrop where the Biden administration, Vice President Harris, and their respective supporters are intensifying their focus on student loan forgiveness as a crucial agenda item.

“We envision a future where no educator struggles under the weight of student loan debt,” affirmed Vice President Harris during an event for the American Federation of Teachers (AFT).

AFT President Randi Weingarten echoed this sentiment on a Progressives for Harris Zoom call, underscoring the aspirations for a future devoid of student debt and one that fosters a flourishing middle class.

Recent announcements from the Department of Education indicate intentions to provide debt relief to millions of borrowers in the coming months, with Education Secretary Miguel Cardona emphasizing the administration’s commitment to addressing the failures of the current student debt system.

Not everyone, however, is convinced of the efficacy of such measures. Some critics view these initiatives, especially when amplified during an election year, as potentially misguided. The recent Supreme Court ruling against the Biden administration’s student debt forgiveness program further adds complexity to the ongoing dialogue.

Rep. Joyce advocates for a shift in universities’ priorities to prioritize affording better value to students through scholarship funding rather than relying on student loans backed by the federal government.

As the conversation around education costs and student debt continues to evolve, the proposals put forth by lawmakers like Rep. David Joyce shed light on alternative solutions that could shape the landscape of higher education financing in the years to come.