Harris and Trump focus on increasing Child Tax Credit

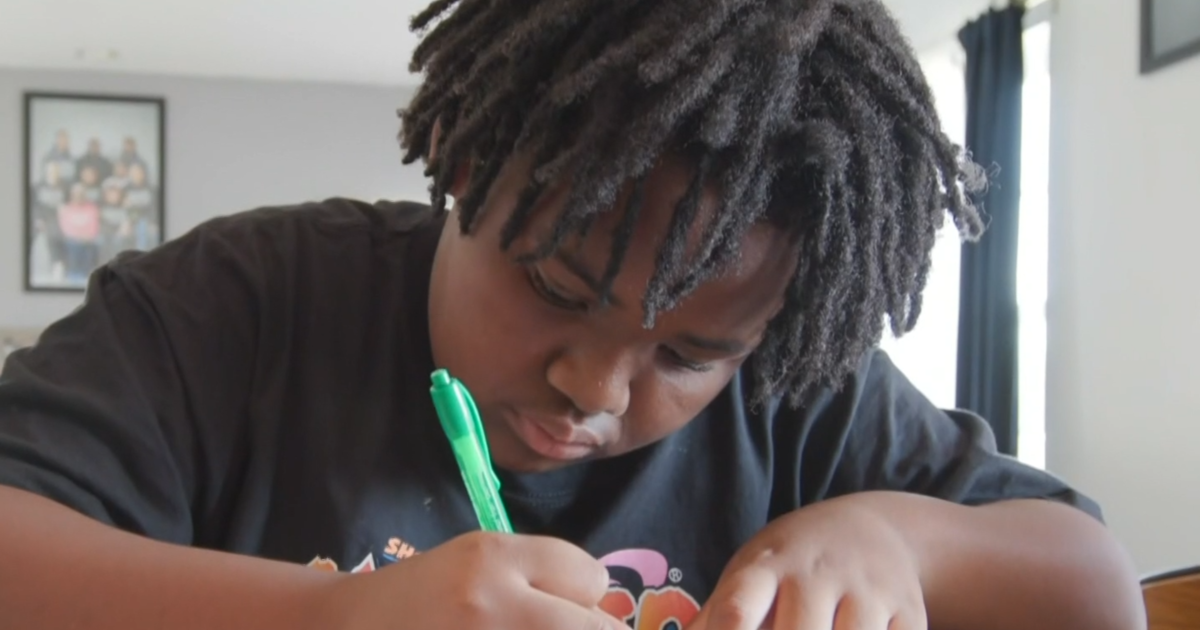

Raising children is a rewarding yet expensive endeavor, as Raegen Selden knows all too well. Residing in Norristown, Pennsylvania, Selden, an office manager, has successfully raised six children, ranging from ages 12 to 25. Her experience sheds light on the financial challenges faced by many families in providing for their children’s needs.

Selden humorously describes her two hungry sons who seem to have insatiable appetites, contrasting with her daughters who may prefer a more dainty approach to eating. To help make ends meet, Selden’s family has long relied on the federal Child Tax Credit, initially established in 1997 to support families with financial assistance.

During the pandemic, the Child Tax Credit received a temporary boost, increasing from $2,000 to $3,000 per child and even reaching $3,600 for families with children under the age of 6. This boost had a significant impact, reducing U.S. child poverty by 46%, as highlighted in a recent report from the U.S. Census Bureau.

While many families benefited from this additional support, the reality of raising a child remains costly. According to a 2022 report by the Brookings Institution, it can cost an estimated $310,000 to raise a child from birth to the age of 18. Recognizing this financial burden, both presidential candidates have expressed support for expanding the Child Tax Credit.

Former President Donald Trump’s proposal includes a $5,000 yearly tax credit per child, aiming to provide more substantial financial relief to families. In contrast, Vice President Kamala Harris suggests a credit of up to $3,600 per child, with a higher amount of $6,000 allocated for newborns. Additionally, Harris proposes making the credit “refundable,” ensuring that even parents who do not pay taxes can benefit from this financial assistance.

Experts like University of Maryland economics professor Melissa Kearney view these proposed changes as a promising step towards improving children’s lives across the country. Kearney emphasizes the positive impact that supplementing the income of low-income families can have on children’s academic performance and long-term health outcomes.

Despite the potential benefits of an expanded Child Tax Credit, the issue of cost remains a significant hurdle. A recent bill seeking to enhance the credit’s coverage failed to garner enough support in the Senate, underscoring the challenges of implementing such financial reforms.

Selden advocates for the importance of providing parents with a Child Tax Credit, emphasizing that children are the future of society and deserve adequate care and support. She notes that ensuring children’s basic needs are met is essential for their growth and development as productive citizens.

In conclusion, the conversation surrounding the Child Tax Credit reflects the ongoing efforts to support families in raising their children on a sound financial footing. As policymakers and experts weigh the options for expanding the credit, the focus remains on promoting the well-being of children and alleviating financial strain on families like Selden’s in Norristown and beyond.