Inflation Stalls, Boosting White House and Markets

Welcome to Boston Post News! Today, we bring you some positive news on the economic front. Consumer prices remained stable in May, thanks in part to a decrease in gas prices, according to the latest report from the Bureau of Labor Statistics.

The consumer price index, which is a key indicator of inflation, showed no change from April to May, bringing the annual inflation rate down to 3.3%. This marks the best monthly performance since July of last year.

While inflation has eased from its peak in 2022, high prices continue to have a negative impact on how voters perceive the economy, a recent poll by The Economist/YouGov revealed.

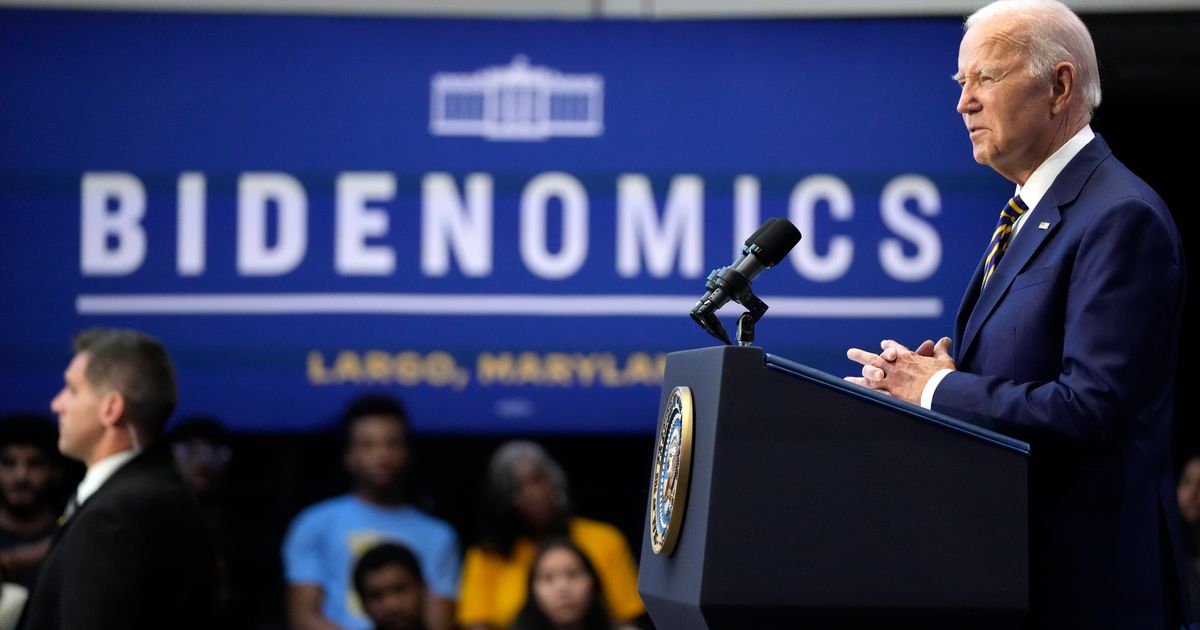

In response to the report, a spokesman for the Biden campaign expressed confidence in the administration’s economic policies. According to James Singer, a spokesperson for Biden-Harris 2024, President Biden has successfully navigated the economy through challenging times, with rising wages and controlled inflation.

The release of the CPI report coincided with a meeting of the Federal Reserve’s committee responsible for setting interest rates. The report could potentially provide support for a future rate cut, as the Fed aims to sustain economic growth.

Economists like Paul Ashworth from Capital Economics are optimistic about the prospects of a rate cut as early as September. Ashworth believes that the encouraging economic fundamentals pave the way for such a move.

Financial markets responded positively to the CPI report, with the Dow Jones Industrial Average rising over 200 points and the S&P 500 reaching a new high.

In May, lower gasoline prices helped offset rising household shelter costs, which constitute a significant portion of consumer spending. The core CPI, which excludes volatile food and energy prices, showed a slight increase of 0.2% in May and 3.4% over the past year.

Shelter prices saw a significant increase of 5.4% over the 12-month period, contributing to the overall rise in the core CPI. Factors such as auto insurance prices, medical care, personal care, and recreation also played a role in driving up inflation.

Some experts argue that the surge in housing and insurance prices necessitates an earlier rate cut by the central bank. Bilal Baydoun from the Groundwork Collaborative emphasized the importance of making housing more affordable for families through timely rate adjustments.

As the debate on future rate cuts continues, the economy’s performance remains a key concern for policymakers and the public alike. Stay tuned to Boston Post News for more updates on this evolving economic landscape.