Supreme Court supports CFPB, Sen. Warren’s creation

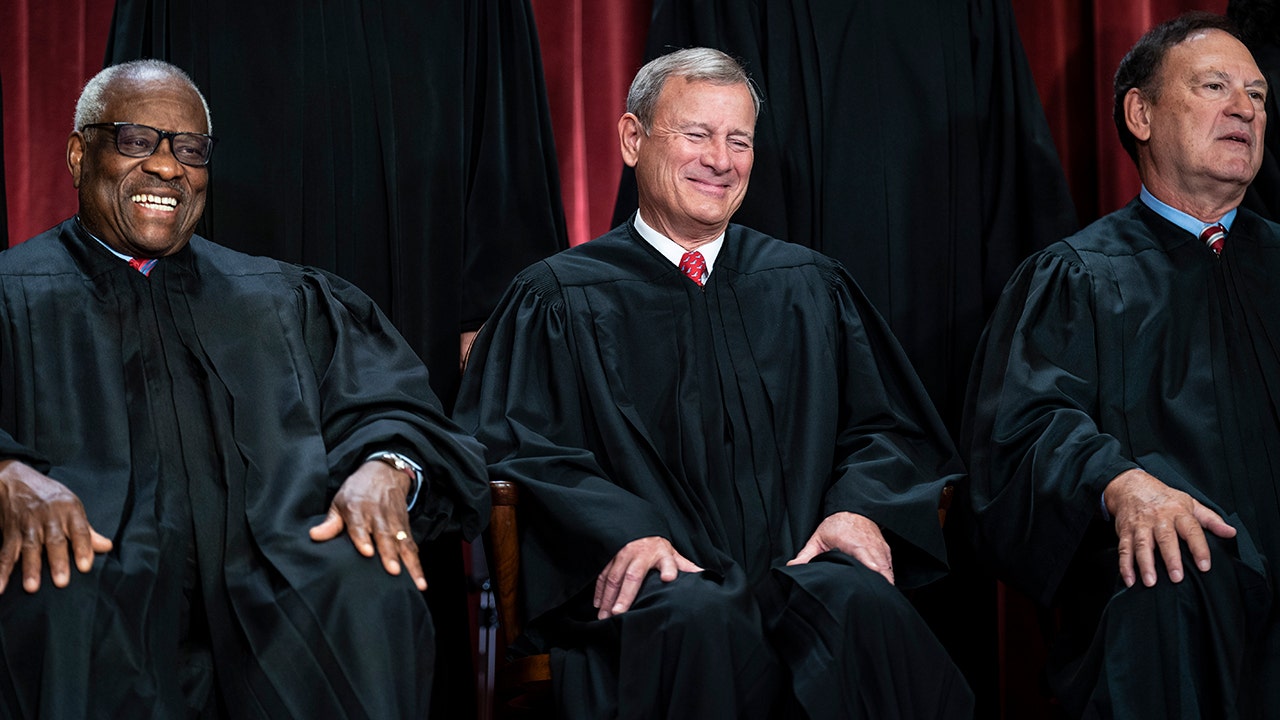

The Supreme Court recently made a significant ruling regarding the funding mechanism of the Consumer Financial Protection Bureau (CFPB), an agency established during the Obama era. In a 7-2 decision, Justice Clarence Thomas authored the opinion, stating that the funding mechanism allowing the CFPB to draw funding directly from the Federal Reserve System is constitutional.

Most federal agencies rely on annual funding from Congress, requiring them to seek funding each year to continue their operations. However, the CFPB operates differently as it is authorized to draw funds directly from the Federal Reserve System, bypassing the usual appropriations process outlined in the Constitution. This unique funding mechanism has been deemed acceptable by the Supreme Court.

The CFPB was founded in 2008 in response to the market crash, with Senator Elizabeth Warren playing a key role in its establishment. The agency is tasked with regulating banking and lending institutions through federal rules. Despite facing a legal challenge from banking associations represented by former solicitor general Noel Francisco, the Supreme Court ultimately upheld the constitutionality of the CFPB’s funding structure.

Justice Clarence Thomas, along with the majority of the court, dismissed the argument that the CFPB’s funding mechanism violates the Appropriations Clause. The court determined that the specific authorization for the Bureau to draw funds from the Federal Reserve System aligns with constitutional requirements.

However, not all justices agreed with the decision. Justice Samuel Alito, joined by Justice Neil Gorsuch, dissented from the majority opinion. Alito criticized the court for upholding a system that allows the CFPB to fund its operations without direct congressional oversight. He argued that the funding scheme goes against the original intent of the Appropriations Clause, which was designed to limit unchecked spending by the executive branch.

In his dissent, Alito emphasized the historical significance of the Appropriations Clause in protecting legislative control over government spending. He expressed concern that the court’s decision sets a dangerous precedent by allowing executive agencies to access funds indefinitely without proper congressional approval.

While the majority view prevailed in this case, the dissenting opinion highlights a broader debate over the balance of power between the branches of government. The implications of this ruling extend beyond the specific funding mechanism of the CFPB, raising questions about the constitutional limits of executive authority and congressional oversight.

As the legal and political landscape continues to evolve, cases like this serve as reminders of the ongoing dialogue surrounding the separation of powers and the role of the judiciary in upholding constitutional principles. The Supreme Court’s decision on the CFPB funding mechanism is a reflection of these complex issues and the need for careful consideration of constitutional interpretation in the modern era.