Understanding Tim Walz’s Economic Policies in Minnesota

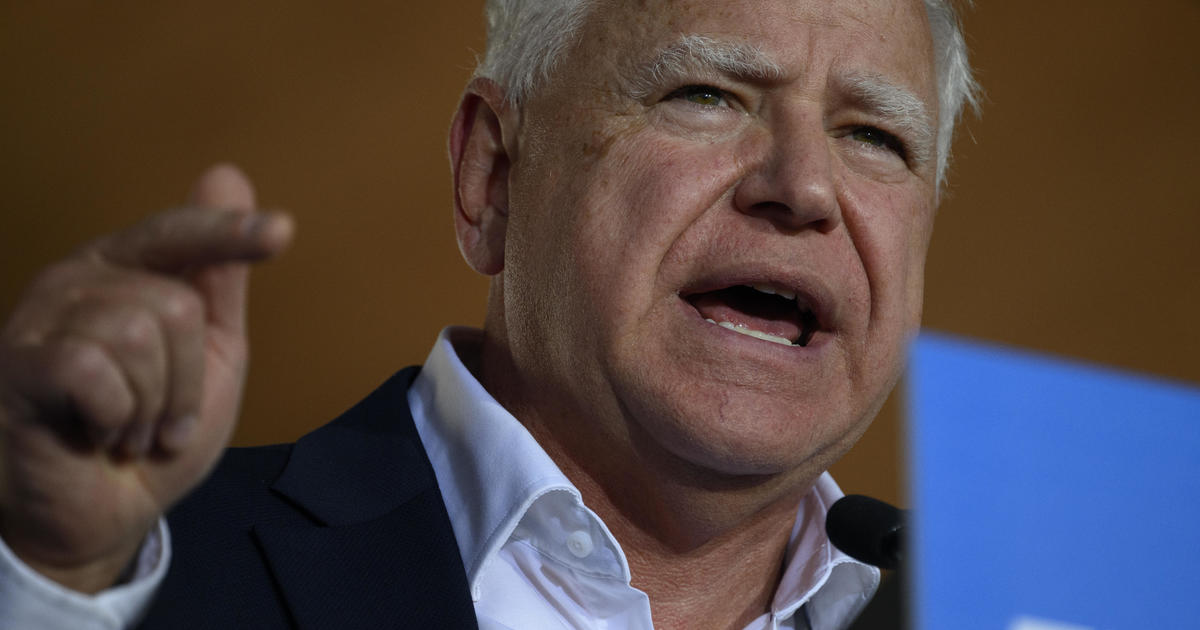

Minnesota Governor Tim Walz, a familiar face in the Midwest, is set to clash with Vice Presidential candidate Sen. JD Vance in a high-stakes debate on CBS. The focus of their discussion will center around taxes and the economy, two pivotal issues that could sway the outcome of the November election.

Recent polls indicate a close race for the 2024 presidential election, with a slight uptick in the number of voters who view the economy positively. However, the majority still perceive the economy as “bad,” making it a top concern among likely voters. As Governor of Minnesota since 2019, Walz’s economic policies have come to define his leadership style. From implementing the largest state Child Tax Credit in the nation to providing free school meals for K-12 students, Walz has prioritized social programs while levying higher taxes on top earners to offset the cost.

Leading tax policy analyst Carl Davis commended Walz for increasing the “progressivity of Minnesota’s tax code,” highlighting the alignment between Walz’s state policies and the broader economic plan put forth by the Harris-Walz ticket. The parallels are unmistakable, with the duo advocating for a more generous federal Child Tax Credit and proposing tax hikes for affluent individuals and corporations.

Minnesota’s groundbreaking Child Tax Credit of $1,750 per child stands as the most generous state-level benefit in the U.S., underscoring Walz’s commitment to supporting families. In contrast, Vance has suggested raising the federal CTC to $5,000, a proposal that faced opposition from Republican lawmakers earlier this year. Tuesday’s debate will likely spotlight Walz’s economic initiatives against Vance’s stance, which has often critiqued Democrats as “anti-family.”

Walz’s agenda also extends to retirees, with his 2023 tax bill eliminating state income taxes on Social Security benefits for most beneficiaries in Minnesota. By focusing on those with annual incomes below $100,000 for couples and $78,000 for single filers, Walz aims to provide relief for seniors. In contrast, former President Donald Trump advocated for a similar federal tax break earlier this year but with different funding mechanisms.

Minnesota’s economic landscape has seen significant growth under Walz’s tenure, with a 5% increase in the state’s gross domestic product since 2018. Despite facing challenges during the pandemic, Minnesota has rebounded to pre-crisis levels, showcasing resilience in its job market. Moreover, the state boasts a median income of $85,000, outpacing the national average and reflecting longstanding prosperity that predates Walz’s administration.

Minnesota’s business-friendly environment has garnered national recognition, ranking sixth among all states for competitiveness, workforce quality, infrastructure, and overall business friendliness. Recent investments from major companies like the Mayo Clinic and Polar Semiconductor underscore the state’s appeal for businesses seeking growth opportunities.

One of Walz’s crowning achievements has been the state’s substantial budget surplus of $17.6 billion for 2023. This surplus has enabled Minnesota to fund ambitious social programs like free school meals, showcasing the positive impact of strong fiscal management on social welfare initiatives.

As the CBS debate approaches, viewers can expect a heated exchange between Tim Walz and JD Vance over contrasting economic visions. The outcome of their discussion may well shape the trajectory of the upcoming election, making it a pivotal moment for both candidates and voters alike.